Strategic Tax

Expert Bookkeeping

Focus on expanding your business while we handle the complexities of bookkeeping with precision and efficiency, ensuring your financial records are accurate and up-to-date.

- Accurate: We handle your books with precision and care to give you a clear picture of your finances.

- Efficient: We make sure your financials are ready for when you need them ensuring a seamless process.

- Easy Access: Accessing your reports and having your questions answered has never been easier.

We make the complex simple

Focus on growing your business, leave the numbers to us.

Profit & Loss

Detailed and accurate insights into your business’s financial performance. We meticulously track your revenues, costs, and expenses to deliver a comprehensive Profit & Loss (P&L) statement.

Balance Sheet

Clear and organized snapshot of your business’s financial position. We meticulously compile and organize your assets, liabilities, and equity to deliver a comprehensive balance sheet.

Vendor Tracking

We accurately monitor and manage all vendor interactions, payments, and agreements, providing you with detailed records and insights ensuring you maintain strong relationships with your suppliers.

Budgeting & Forecasting

Plan for the future with confidence. We create detailed budgets and financial forecasts tailored to your business, enabling you to set realistic goals and make informed decisions.

Audit Support

Expert assistance throughout the audit process. We prepare and organize your financial records, ensuring accuracy and compliance to help you navigate audits smoothly and efficiently.

Financial Consulting

Our expert guidance is here to help you make informed financial decisions and achieve your business goals. Strategic advice and insights tailored to your unique needs, planning for a profitable future.

Getting started has never been easier

Seamless Onboarding

Our dedicated team takes the time to understand your business and integrates with your financial data sources, creating a customized bookkeeping approach that lays the foundation for precise financial records.

Transparent Communication

Connect directly with your bookkeeper where you can ask questions and offer feedback on any pending items needed to complete your monthly books.

Detailed Finanical Reports

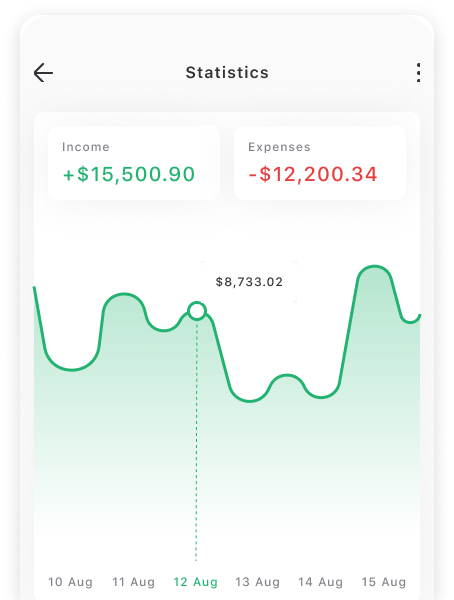

We provide monthly Profit & Loss, Balance Sheet, cash flow statements and much more that reveal valuable insights into your company’s financial well-being, empowering you to make informed decisions.

Partner With Us For The Long Term

Our goal is to help you build a strong foundation for your finances and understand them too. This way you can focus on what matters most: Growing Your Business.

Flexibility

Tailored solutions that evolve with your business needs. We adapt our approach as your goals change.

Reliability

Consistent support you can count on every step of the way. We deliver fast, clear communication.

Expertise

Industry-leading insights driving your long-term success. Our experts stay ahead of evolving tax trends.

The last accountant you'll ever need.

Business & Entity Formation

Starting your business is a significant step, and our dedicated team helps simplify the process—laying a solid foundation for your long-term success.

- Ideal Structure: We make sure you're set up right from the start.

- Documentation: Ensure your documents are stored and in order.

- Compliance: Adherence with all regulations

- Peace of Mind: Focus on getting your business and your customers.

A Bookkeeper that Cares

Our Bookkeeping service is designed to simplify your financial management by keeping your records accurate and up-to-date. This dedicated service offers comprehensive solutions—from recording daily transactions and reconciling accounts to preparing detailed financial reports and ensuring compliance with tax regulations.

- Attention to Detail: We meticulously categorize all transactions.

- Communication: We start on the same page and stay there.

- Financial Reports: Detailed outlooks on your company's financials.

- Taxes Simplified: Easily transition your reports to your taxes.

Tax Season Simplified

Leave the stress behind while our expert team streamlines every step of the process—from organizing your documents to maximizing your deductions—ensuring a smooth, hassle-free experience so you can focus on what truly matters.

- Federal & State: We handle all aspects of your tax return.

- Expert Knowledge: 30+ years of industry experience.

- Stay Ahead: We stay up to date on current tax regulations.

- Personal Taxes: Preparation and filing of your personal taxes.

Frequently Asked Questions

Clear & concise answers to your most common queries, ensuring you have the information you need at your fingertips.

Should I manage bookkeeping in-house, or should I outsource it?

Managing bookkeeping in-house might seem feasible, but it can distract you from what really matters—growing your business. By outsourcing your bookkeeping to a professional bookkeeper, you ensure accurate, up-to-date records while freeing your time and resources to focus on strategic initiatives and market expansion. This approach leverages expert technology and oversight, reducing errors and allowing you to concentrate on scaling your business.

Can you help me with my business taxes?

Yes we can! Give us a call at 908-931-9310 or fill out our contact form and we can help you file your business tax return.

Can you help me with my personal taxes?

Yes we can! GIve us a call at 908-931-9310 or fill out our contact form and we can help you file your personal taxes.

What is a "write-off"?

Essentially, it’s an expense that helps adjust your financial records to reflect a more accurate profit(or loss) and can lower your taxable income by acknowledging expenses in the current period.

What are the essential financial records I need to maintain for my business?

The core records include a general ledger, bank statements, invoices, receipts, expense logs, payroll records, and tax filings. Additionally, maintaining detailed accounts receivable and payable ledgers, along with supporting documents like contracts and purchase orders, is critical. These records not only help track your financial performance but also support tax compliance and strategic planning. At Strategic Tax & Accounting, we do this all for you.

How does bookkeeping impact my taxes?

Accurate bookkeeping ensures that all income and expenses are properly recorded, helping you claim all eligible deductions and maintain compliance with tax regulations. This not only minimizes the risk of errors and audits but also simplifies tax preparation by providing a clear financial record.

What is the difference between cash and accrual bookkeeping?

Cash bookkeeping records transactions only when money actually changes hands, while accrual bookkeeping records income and expenses when they are earned or incurred, regardless of payment. This choice affects how revenue and expenses appear on your financial statements and can influence tax planning and reporting.

What am I allowed to write off?

Generally, you can write off expenses that are both ordinary and necessary for your business. This might include costs like office supplies, equipment, travel, meals (subject to limitations), rent, utilities, and depreciation on business assets. However, the specifics can vary based on your business type and local tax laws, so it’s best to consult a tax professional or refer to IRS guidelines to ensure you’re taking all the deductions you’re eligible for.